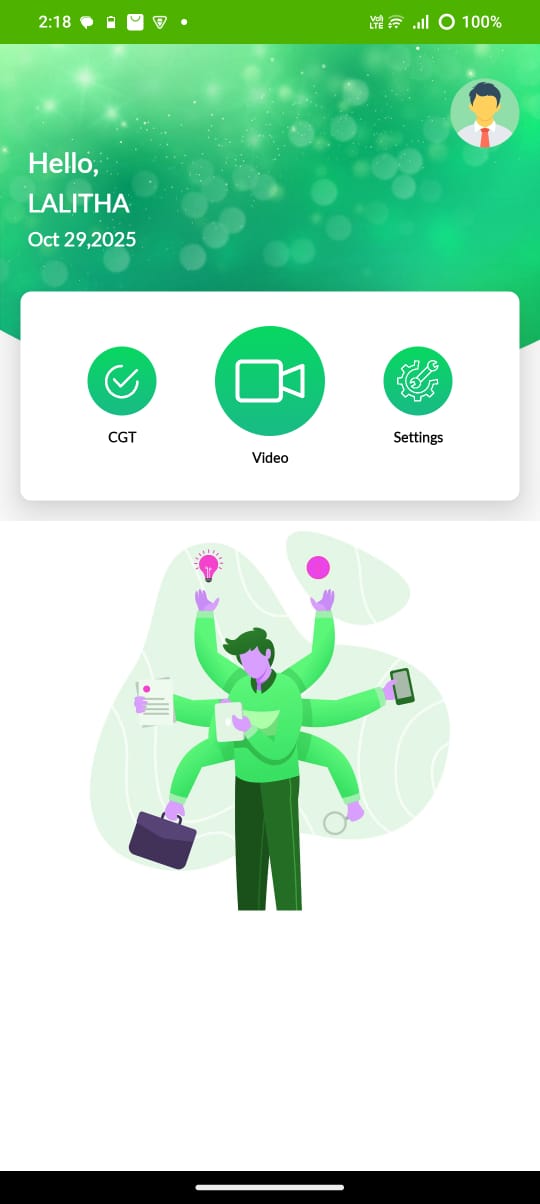

Loan Origination System

Streamline Your Lending Process with CIMS SOFT

At CIMS SOFT, we develop secure, intelligent, and fully automated Loan Origination Systems (LOS) designed to simplify and digitize every stage of the loan lifecycle. From customer onboarding to disbursal, our LOS solutions help financial institutions, NBFCs, and fintech companies reduce turnaround time, improve efficiency, and deliver a seamless borrower experience.

Our Loan Origination System is built with advanced technology, robust integrations, and real-time validation — ensuring accuracy, compliance, and complete process automation.

🧩 Key Modules Included in the Loan Origination System

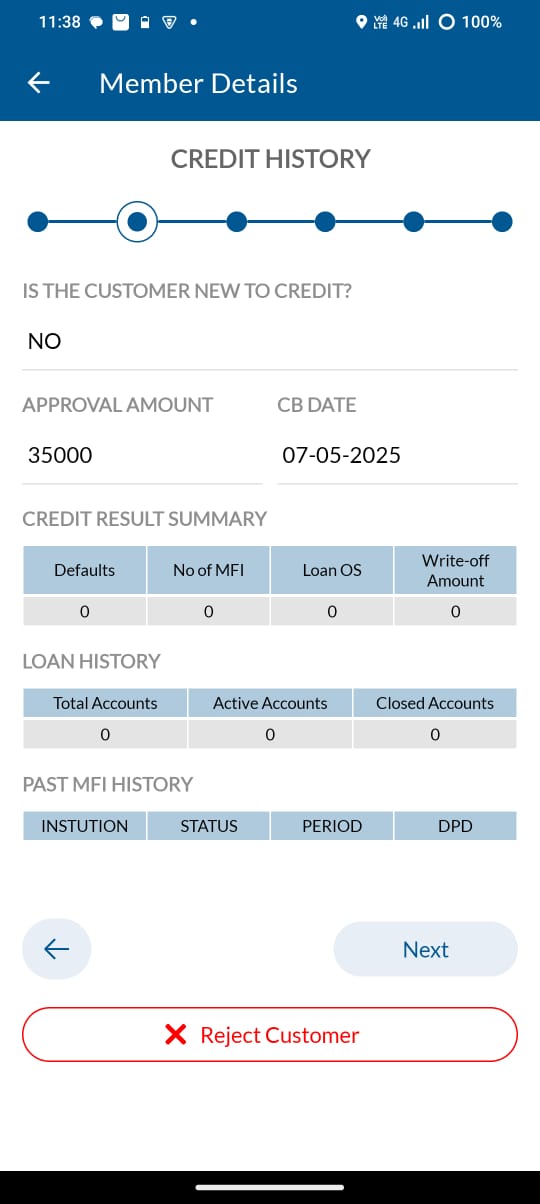

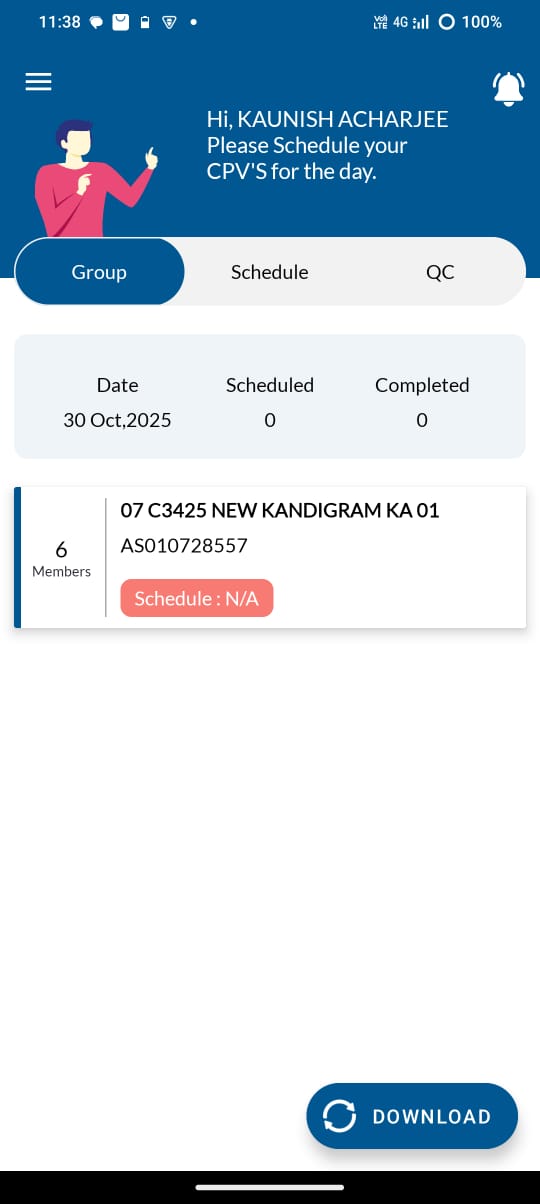

A Loan Origination System (LOS) is an end-to-end digital platform that automates and manages the complete loan processing cycle — from the initial loan application to the final disbursement of funds. It acts as the backbone of any lending organization, ensuring faster processing, better compliance, and improved customer satisfaction. The LOS eliminates manual interventions by integrating all critical loan functions such as customer onboarding, credit appraisal, document verification, approval workflows, and disbursement under one unified system.

-

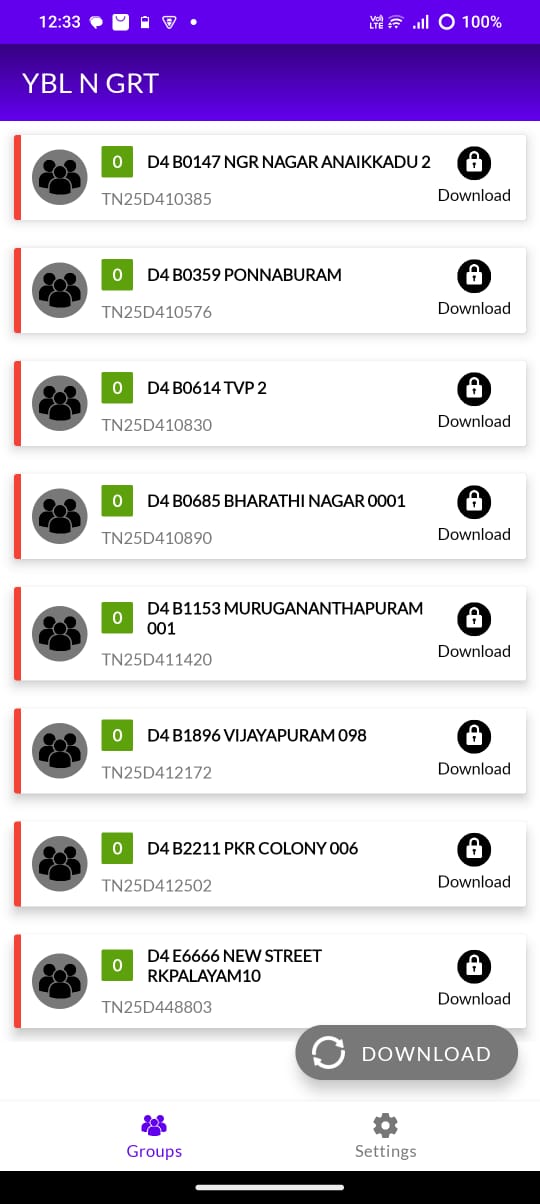

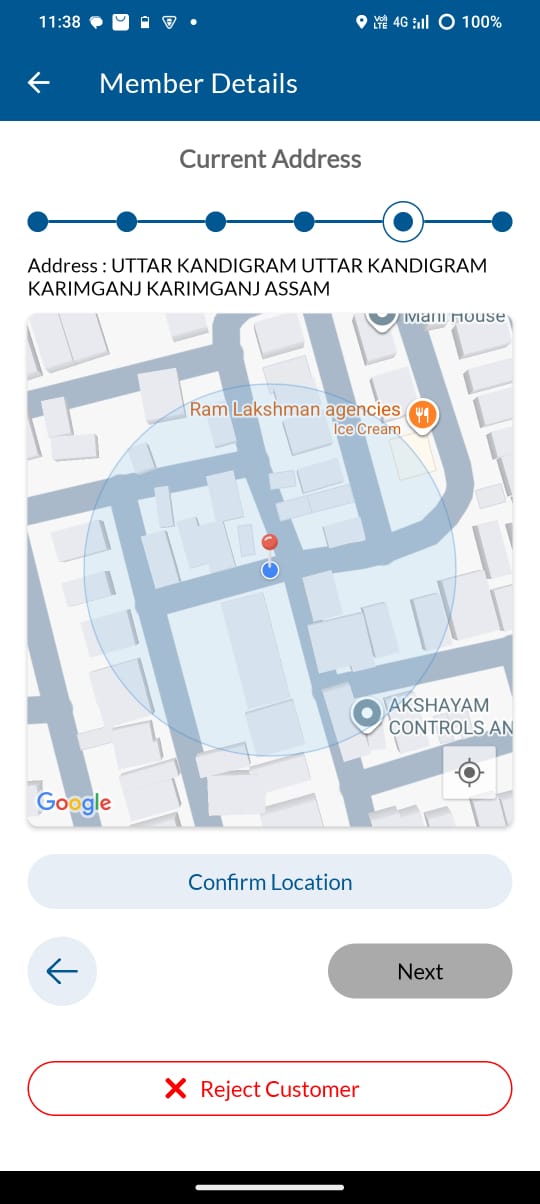

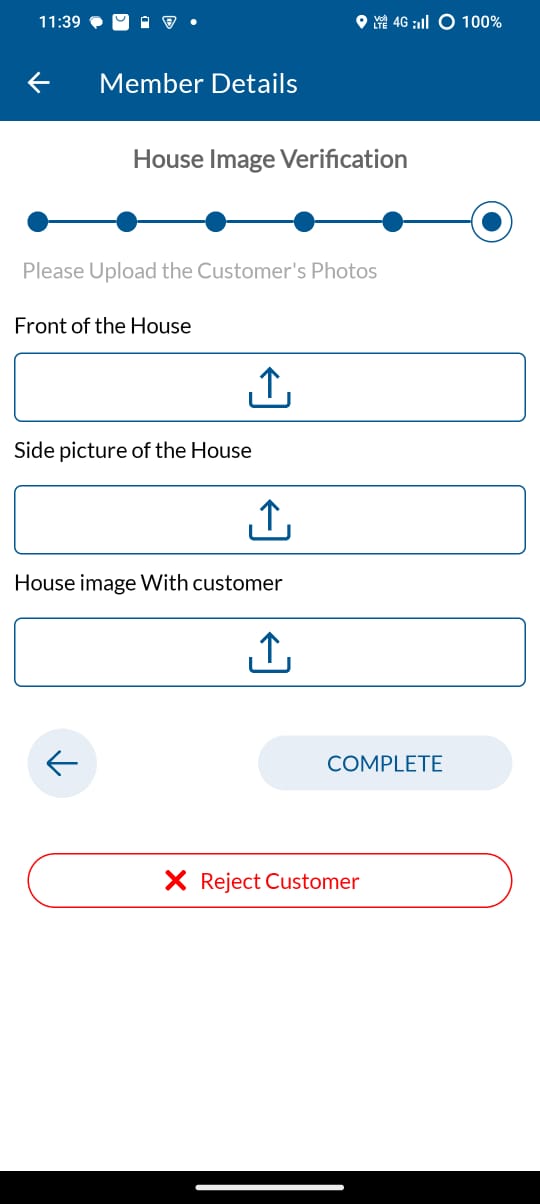

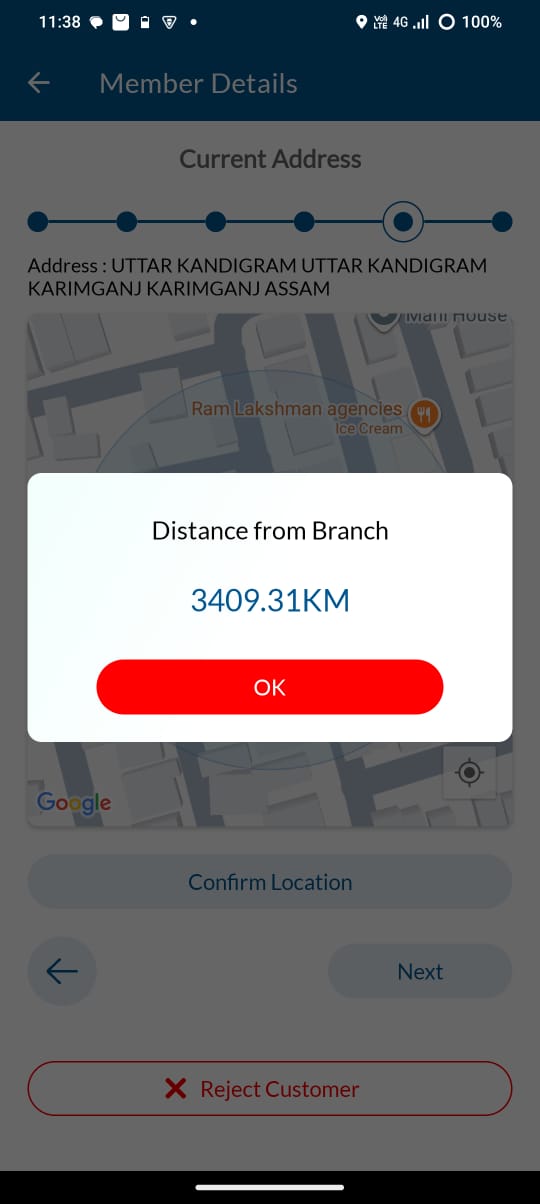

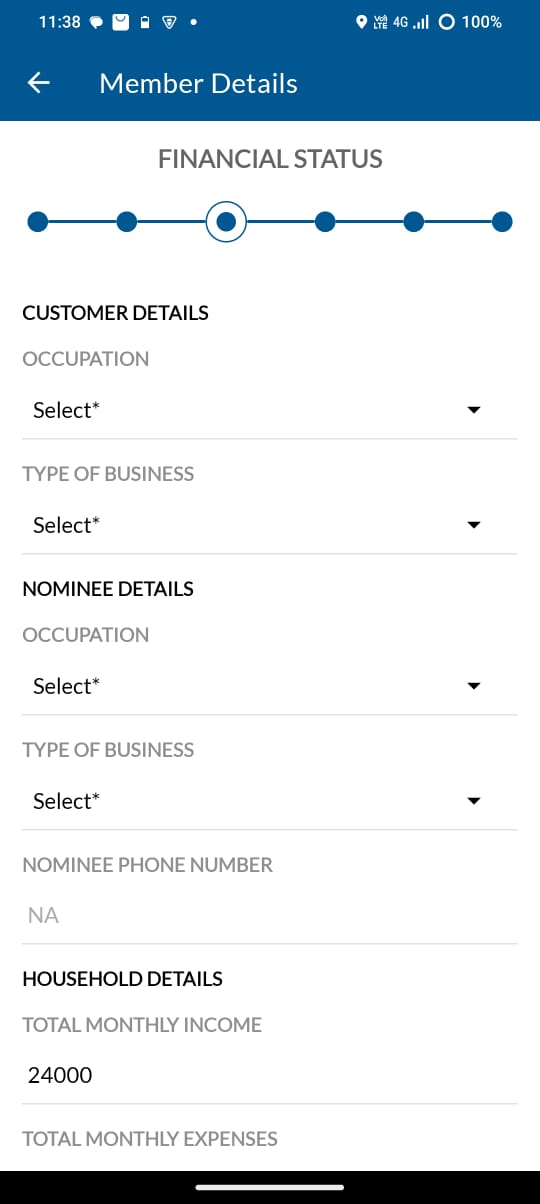

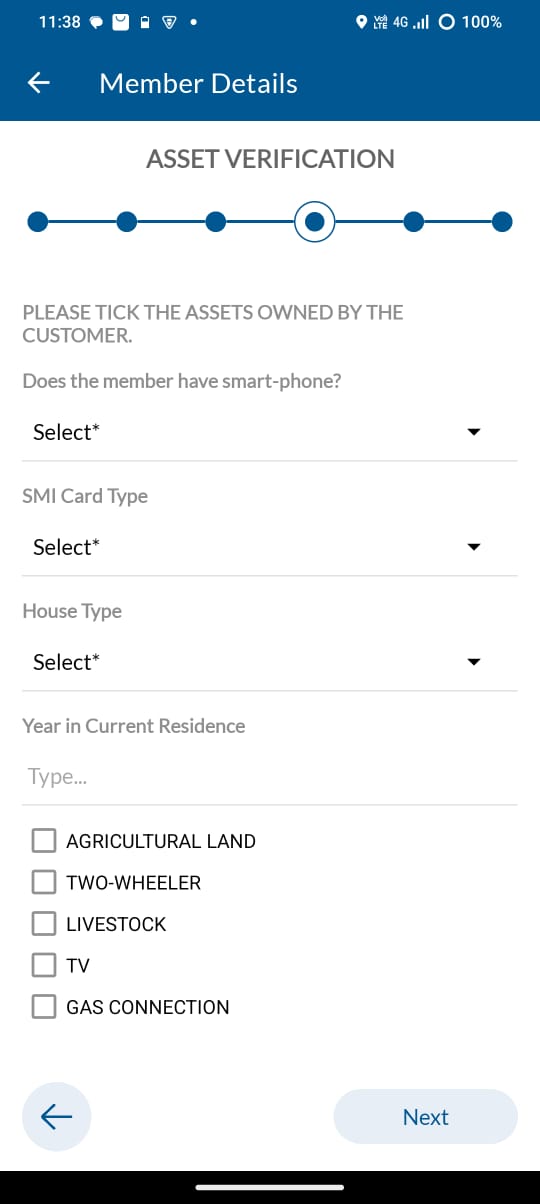

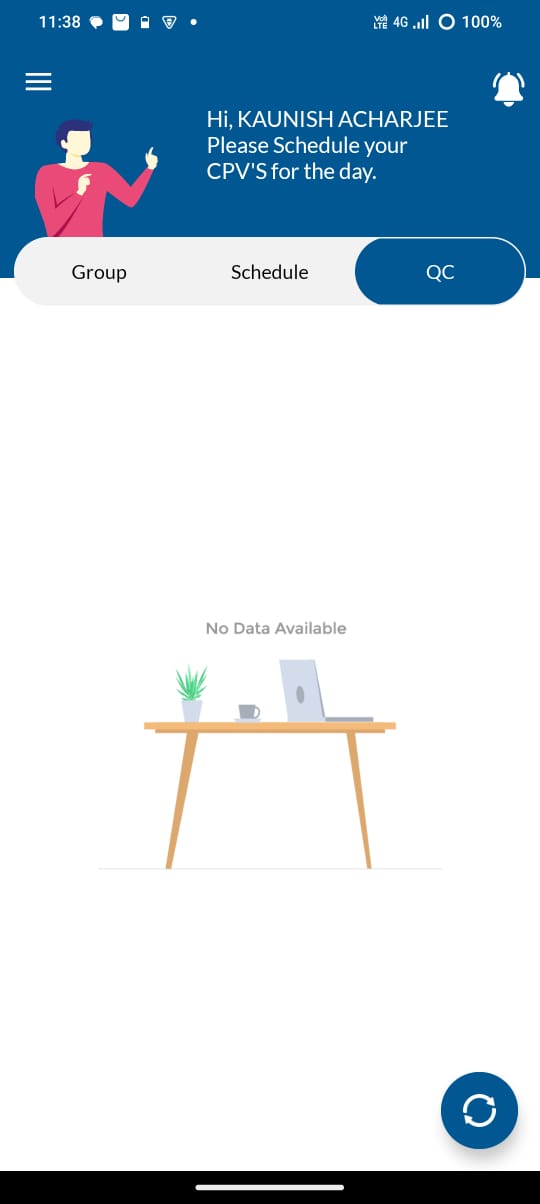

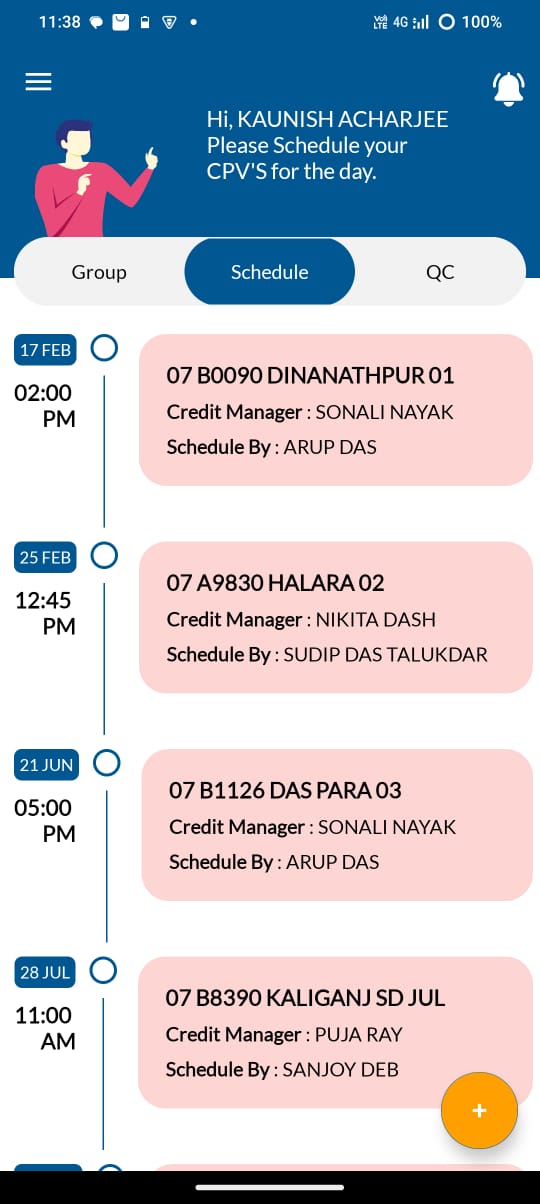

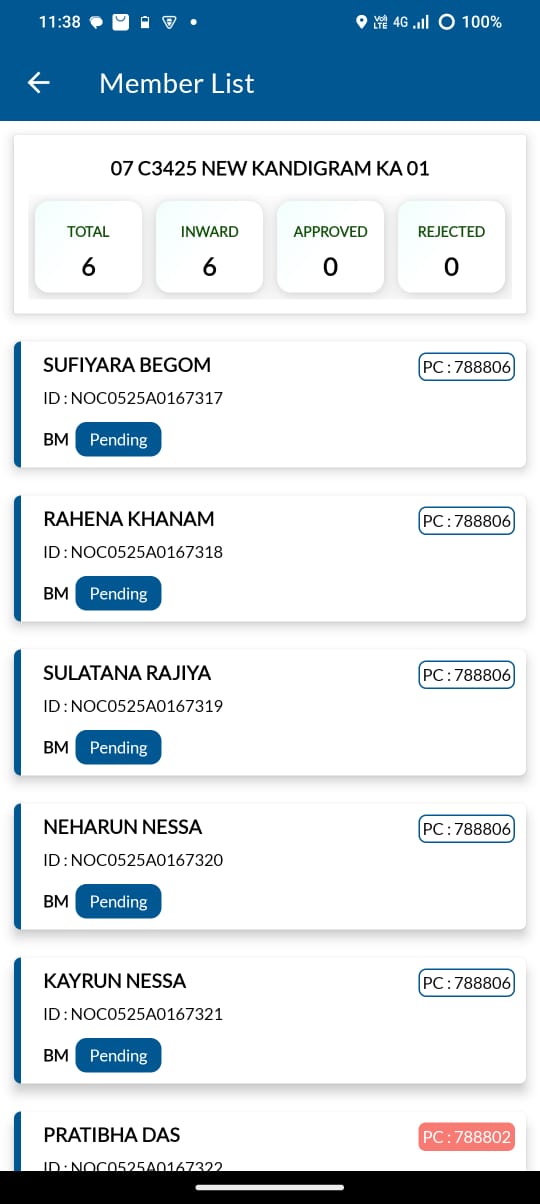

Member Sourcing

Digitally capture and manage borrower information through easy-to-use interfaces. Automate lead assignment, application tracking, and performance monitoring for field agents and channel partners.

-

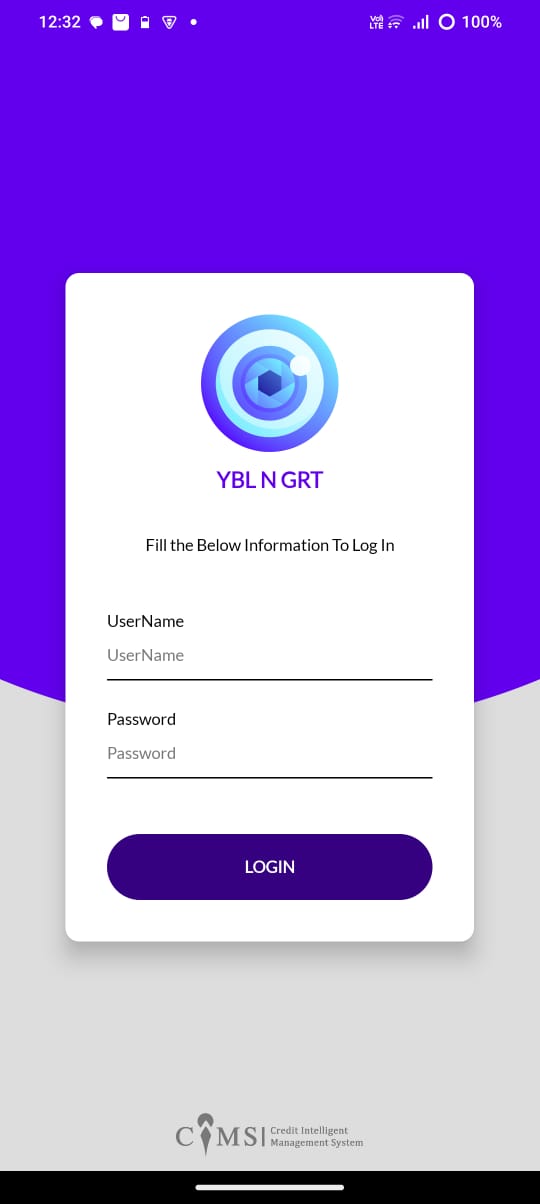

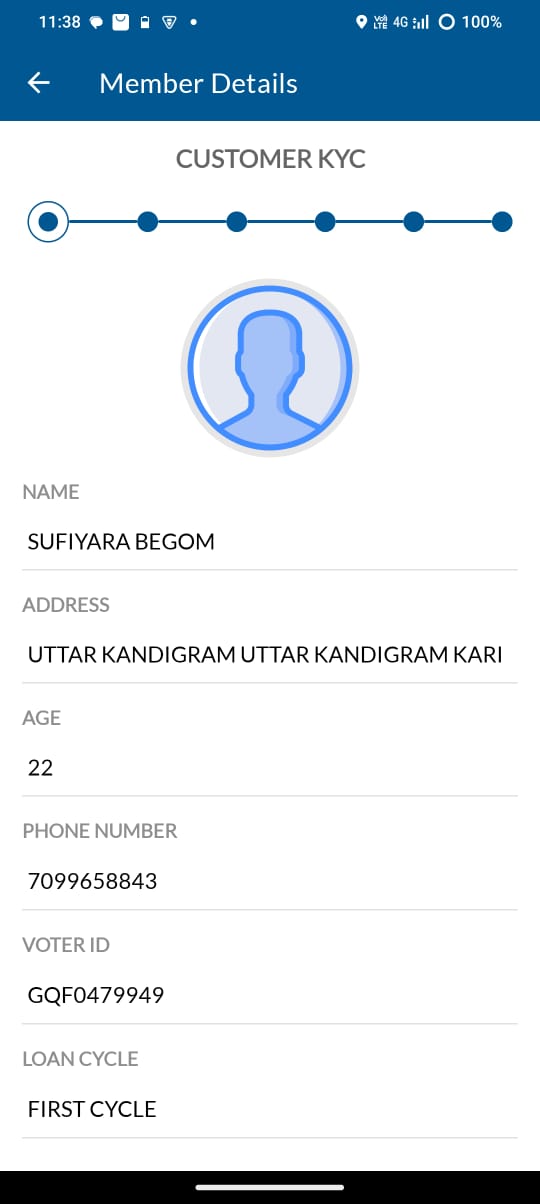

eKYC (Electronic Know Your Customer)

Instant identity verification through integration with Aadhaar, PAN, and other government databases. Enables fast and paperless onboarding while ensuring compliance with KYC norms.

-

Penny Drop Verification

Validate customer bank accounts in real-time by processing small test transactions. This step ensures the authenticity of the provided bank details before loan disbursal.

-

Deduplication Check

Avoid duplicate loan applications and fraudulent entries using intelligent deduplication algorithms. Maintain data integrity and ensure a clean customer database.

-

Bank Verification

Seamless API integration with banking systems to verify account ownership, IFSC codes, and transactional authenticity — minimizing risks and manual intervention.

-

Disbursal Management

Automate loan disbursement workflows with secure payment gateway integration. Ensure accurate fund transfer, real-time notifications, and complete audit tracking for all transactions.

🌟 Why Choose CIMS SOFT for LOS Development?

- Custom-Built Solutions - Tailored LOS platforms to fit your institution’s lending model and business rules.

- API-Driven Integrations - Connect seamlessly with credit bureaus, payment gateways, and verification services.

- Regulatory Compliance - Aligned with RBI, KYC, and data protection standards.

- Real-Time Processing - Instant validation and status updates throughout the loan cycle.

- Secure Architecture - Enterprise-level data encryption and role-based access controls.

- Scalable & Modular Design - Expand functionalities easily as your lending business grows.

🚀 Key Benefits of CIMS SOFT LOS

- Faster loan processing and approvals

- Reduced manual errors and paperwork

- Enhanced customer experience and transparency

- Centralized loan management and analytics

- Automated decision-making with rule-based workflows

- Improved operational efficiency and cost savings

Avg. Existing System

Level is Medium

Avg. Proposed System

Level is high

- Automation

- Transparency

- Efficiency

- Compliance

A Loan Origination System (LOS) is a critical solution for financial institutions aiming to digitize and simplify their lending operations. By automating every stage of the loan journey — from application to disbursement — LOS enhances operational efficiency, reduces costs, ensures compliance, and delivers a superior borrower experience.

💡 Empower Your Lending Operations

With CIMS SOFT, transform your traditional lending into a smart, digital-first process. Our Loan Origination System delivers speed, accuracy, and control — helping you make faster credit decisions and build lasting customer relationships.

CIMS SOFT – Your trusted technology partner for digital lending transformation.